To accurately calculate depreciation, a property owner must determine the basis of the property, which is generally the cost of acquiring the property plus any improvements minus any land value.

The IRS dictates specific methods and schedules for calculating depreciation, which can be complex but are essential for ensuring legal compliance and maximizing tax benefits.

Record-keeping and reporting play a significant role in depreciation, as property investors must maintain accurate records of all costs associated with acquiring, improving, and maintaining the rental property.

Key Takeaways

- Depreciation spreads the cost of a rental property over 27.5 years for tax reduction.

- Only the building’s value is depreciable, not the land.

- Accurate record-keeping is essential for depreciation calculations.

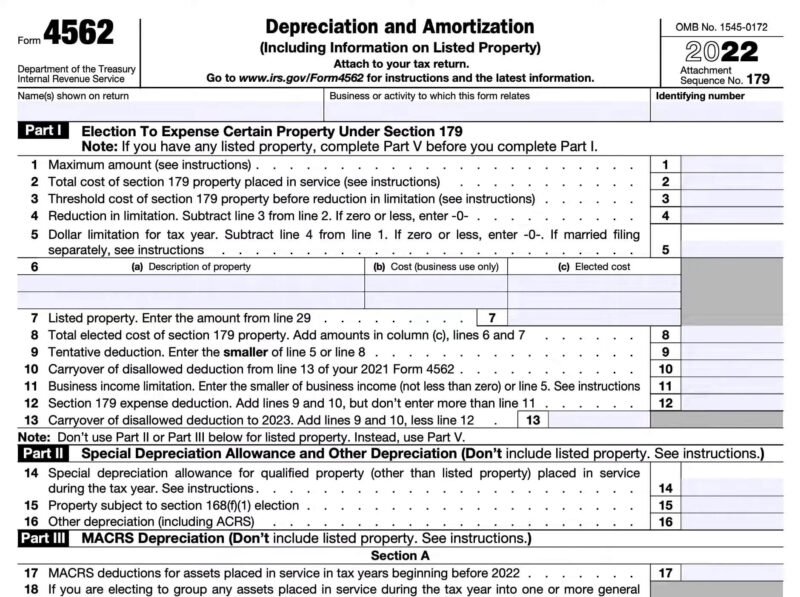

- IRS Form 4562 is used to report annual depreciation on taxes.

- Improvements are depreciated; repairs are deducted in the year they occur.

Overview

Depreciation is an accounting method used to allocate the cost of a tangible asset over its useful life. For residential rental property, the Internal Revenue Service (IRS) has determined the useful life to be 27.5 years. Thus, each year, investors can deduct a portion of the property’s cost from their taxable income, which doesn’t include the land value, as land is not depreciable.

Benefits of Depreciating Rental Property

Depreciating rental property offers two main benefits:

- Tax Reduction: Depreciation is considered a non-cash expense. It does not affect cash flow, allowing property owners to report a lower taxable income, thus reducing their tax liability for the year.

- Cash Flow Improvement: By lowering taxable income, depreciation effectively increases the amount of money investors keep from rental income, enhancing overall cash flow while the asset continues to generate rental revenue.

Depreciation Methods

Depreciation on rental property is a systematic way of allocating the cost of the property over its useful life. Property owners may choose from several IRS-recognized depreciation methods, each with its specific calculation process and application rules.

Straight-Line Depreciation

Straight-Line Depreciation is the most commonly used method where the property’s cost is evenly spread over the IRS-specified useful life of the asset. For residential rental properties, this period is typically 27.5 years. To calculate the annual depreciation expense, one would subtract the land value from the property’s purchase price and divide the result by 27.5 years.

Modified Accelerated Cost Recovery System (MACRS)

The Modified Accelerated Cost Recovery System (MACRS) allows for a faster depreciation pace than the Straight-Line Method. It involves two different systems: the General Depreciation System (GDS) and the Alternative Depreciation System (ADS). Under MACRS, the GDS generally uses a recovery period of 27.5 years for residential property, but it enables a more accelerated depreciation in the early years of the property’s life. The ADS, on the other hand, uses a longer recovery period under MACRS and is generally used when business property is required to use a longer life by law or when elected by the taxpayer.

Calculating

When calculating depreciation on rental property, it’s essential to follow a systematic process that accurately reflects the property’s decrease in value over time due to wear and tear.

Assessing Property Value

The first step is to determine the current value of the property in question. It’s important to only consider the value of the buildings themselves, as land does not depreciate. An appraisal or property tax assessment can often serve as a reliable indicator of the property’s current value.

Determining the Depreciable Basis

After the property’s value has been assessed, one must calculate the depreciable basis. This is typically the cost of acquiring the property, including purchase price, legal fees, and other associated expenses. The value of the land is excluded from this figure since land is not subject to depreciation.

Applying the Depreciation Method

The most commonly used method for depreciating rental property is the straight-line method, which deducts the same amount of depreciation each year. For residential rental properties, the Internal Revenue Service (IRS) has determined a recovery period of 27.5 years. Therefore, each year, the owner can depreciate the property by dividing its basis by 27.5.

Record-Keeping and Reporting

Proper record-keeping and accurate reporting are crucial for calculating depreciation on rental property. They ensure compliance with tax laws and assist in maximizing potential tax benefits.

Documentation Requirements

Documentation for rental property depreciation must be meticulous. The Internal Revenue Service requires owners to keep records that detail the purchase price, improvement costs, and the date of service (when the property was first rented). They must also document all expenses related to the acquisition of the property, such as legal fees and recording fees. Keeping these records organized is essential for substantiating depreciation calculations if ever scrutinized by tax authorities.

- Initial Costs: Purchase price, legal fees, recording fees.

- Improvements: Additions, renovations, and upgrades to increase the property’s value.

- Date of Service: The date when the property was first available for rent.

Tax Filing for Depreciation

When it comes to filing taxes, property owners utilize IRS Form 4562 to report depreciation. The form is used to itemize and calculate the depreciation expenses for their rental property each year. This expense deduction has a direct impact on the owner’s taxable income, as it reduces the amount subject to taxation. The life span of residential rental property, as defined by the IRS, is 27.5 years, meaning owners can allocate the property’s value over this duration to determine their annual deductible expense.

- Form Required: IRS Form 4562 for depreciation and amortization.

- Annual Deduction: Property cost divided by 27.5 years.

- Impact on Taxable Income: Decreases taxable amount through depreciation deduction.

Special Considerations

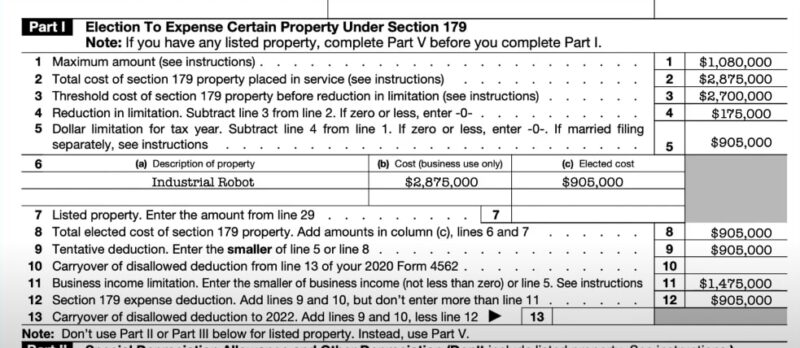

When calculating depreciation on rental property, property owners must give attention to specific IRS rules that distinguish between improvements and repairs, as well as the implications of Section 179 and bonus depreciation, which can affect the depreciation schedule.

Improvements versus Repairs

Improvements to a rental property refer to any work done that increases its value, prolongs its useful life, or adapts it to new uses. These costs are capitalized and depreciated over the property’s life. To calculate depreciation for improvements, one must spread the cost over 27.5 years for residential properties.

In contrast, repairs are necessary to keep the property in good working condition and do not materially add to its value or extend its life. These expenses are deductible in the year they are incurred. Examples of repairs include fixing leaks, painting, or replacing broken windows.

Section 179 and Bonus Depreciation

Section 179 deduction allows property owners to recover the cost of qualifying property, such as machinery or equipment, in the year it is placed in service. This deduction is subject to limits and phase-out thresholds, which the IRS sets annually.

Bonus depreciation is an additional amount of deductible expense that property owners can claim for new and used business assets, including rental property. The Tax Cuts and Jobs Act (TCJA) expanded bonus depreciation to 100% for property acquired and placed in service after September 27, 2017, and before January 1, 2023. Eligible assets can be written off entirely in the first year of service rather than being depreciated over the asset’s useful life.

Frequently Asked Questions

What is the formula for calculating depreciation on a rental property?

The general formula for calculating depreciation on a rental property involves dividing the property’s cost basis by the recovery period established by the IRS, typically 27.5 years for residential properties.

Which depreciation method is most advantageous for rental properties?

For rental properties in the United States, the most advantageous and commonly used method is the Modified Accelerated Cost Recovery System (MACRS). This method allows for a greater depreciation expense in the early years of property ownership.

How does one recapture depreciation upon the sale of a rental property?

When a rental property is sold, depreciation recapture is required. The amount of depreciation claimed over the years is subject to tax at a 25% rate, as it is recaptured by the IRS when the property is sold.

Is it mandatory to depreciate a rental property for tax purposes?

Yes, rental property owners must depreciate their property over its useful life as per IRS rules. Failure to do so could result in complications if audited, including potential penalties and interest on the unclaimed depreciation.

How can an investor utilize catch-up depreciation for a previously undepreciated rental property?

An investor can use catch-up depreciation to adjust for previous years when depreciation was not claimed. The process involves filing an IRS Form 3115 to make the adjustment and claim the missed depreciation expenses.

Are there any income limits that affect the depreciation of rental properties?

There are no direct income limits affecting the depreciation of rental properties. However, passive activity loss rules may limit the ability to deduct losses, including depreciation, against active or portfolio income for certain high-income investors.

Conclusion

Understanding and accurately calculating depreciation on rental property is crucial for property investors to maximize tax benefits and enhance cash flow. By adhering to IRS guidelines, maintaining meticulous records, and utilizing the correct forms, investors can ensure compliance and optimize their investment strategy. Depreciation not only offers a significant tax advantage but also reflects the property’s value decrease over time, making it an essential component of real estate investment analysis.