Understanding federal income tax rates is crucial for financial planning and compliance. In 2024, the U.S. federal income tax system will maintain a progressive structure, with rates increasing as income rises.

Taxpayers fall into various brackets depending on their income level, with the percentage taxed escalating in tandem with their earnings.

The federal income tax structure includes several brackets, with the specific rates established by the Internal Revenue Service (IRS) considering inflation adjustments and legislative changes.

Individuals’ tax responsibilities differ based on their filing status—single, married filing jointly, married filing separately, or head of household.

Awareness of these brackets enables taxpayers to estimate their tax burden effectively.

Key Takeaways

- U.S. income tax rates range from 10% to 37%, depending on income and filing status.

- 2024 tax brackets are adjusted for inflation, impacting all filers.

- Standard deductions increase, lowering taxable income for taxpayers.

- Key credits and deductions can significantly reduce taxes owed.

- The AMT targets high-income earners, with adjusted exemption amounts.

- Tax filing includes selecting the correct status and meeting the April 15 deadline, with extension options available.

Overview

Federal income tax structure in the United States operates with seven distinct brackets. These brackets apply graduated tax rates which increase as a taxpayer’s income rises. The specific rates for 2024 remain as follows: 10%, 12%, 22%, 24%, 32%, 35%, and the highest at 37% according to NerdWallet.

The income thresholds associated with these brackets also undergo periodic adjustments. For the year 2024, individuals filing as single taxpayers are subject to a top marginal rate of 37% on income exceeding $609,350. For married couples filing jointly, this rate applies to income above $731,200. These adjustments ensure the tax system accommodates inflation and maintains progressivity.

The federal income tax system remains non-regressive, ensuring that higher-income earners pay a larger percentage of their income in taxes compared to lower-income earners. This system is an essential component of the U.S. revenue collection, funding various government services and programs.

Taxpayers also need to be aware that deductions and tax credits can lower their overall tax liability. The standard deduction, which can reduce taxable income, is also adjusted for inflation annually.

Income Tax Brackets and Rates

In 2024, the United States federal income tax system uses progressive rates, which means that as an individual’s income increases, the tax rate applied to the next increment of income also increases. These rates are segmented into different brackets, where each bracket corresponds to a specific income range.

Single Filers

- 10% on income up to $10,275

- 12% on income over $10,275 to $41,775

- 22% on income over $41,775 to $89,075

- 24% on income over $89,075 to $170,050

- 32% on income over $170,050 to $215,950

- 35% on income over $215,950 to $539,900

- 37% on income over $539,900

For single filers, the tax rate begins at 10% for the lowest-income earners and gradually increases to a maximum of 37% for those with the highest taxable income.

Married Filing Jointly

- 10% on combined income up to $20,550

- 12% on income over $20,550 to $83,550

- 22% on income over $83,550 to $178,150

- 24% on income over $178,150 to $340,100

- 32% on income over $340,100 to $431,900

- 35% on income over $431,900 to $647,850

- 37% on income over $647,850

Married couples filing jointly will find that their income is taxed at similar rates at roughly double the income thresholds compared to single filers.

Married Filing Separately

- 10% on income up to $10,275

- 12% on income over $10,275 to $41,775

- 22% on income over $41,775 to $89,075

- 24% on income over $89,075 to $170,050

- 32% on income over $170,050 to $215,950

- 35% on income over $215,950 to $323,925

- 37% on income over $323,925

Married individuals choosing to file separately will see their tax brackets halved relative to the income thresholds for joint filers, with the same progressive rates applicable.

Head of Household

- 10% on income up to $14,650

- 12% on income over $14,650 to $55,900

- 22% on income over $55,900 to $89,050

- 24% on income over $89,050 to $170,050

- 32% on income over $170,050 to $215,950

- 35% on income over $215,950 to $539,900

- 37% on income over $539,900

Those filing as Head of Household, typically single filers with dependents, benefit from wider tax brackets compared to single filers, meaning more income is taxed at lower rates.

Standard Deduction and Exemptions

Taxpayers can expect certain adjustments to the standard deduction that may impact their federal income tax, or even sale tax. These deductions play a critical role in reducing taxable income, essentially setting the baseline of what portion of an individual’s or couple’s income is not subject to federal income tax.

- Single Filers: The standard deduction for single filers will be $14,600.

- Married Filing Jointly: Couples who file jointly will see a standard deduction of $29,200.

- Head of Household: For heads of household, the standard deduction amount is set at $21,900.

In addition to the standard deduction, taxpayers 65 or older, or those who are blind, may qualify for an additional standard deduction, which further reduces their taxable income.

Tax Credits and Deductions

Tax credits are favorable for taxpayers as they reduce the amount of tax owed, dollar for dollar. Some commonly used tax credits include:

- Child Tax Credit: For families, which can be significant for each qualifying child.

- Earned Income Tax Credit (EITC): Aimed at low- to moderate-income working individuals and couples, particularly those with children.

Itemized Deductions

Taxpayers have the option to itemize deductions, which can be more beneficial than taking the standard deduction if their expenses are substantial. Common itemized deductions include:

- Mortgage Interest: Homeowners can deduct interest on their mortgage up to a specific limit.

- State and Local Taxes (SALT): Deductions are allowed for state and local taxes paid, though there are caps on the amount.

By utilizing these credits and deductions, taxpayers can effectively manage their tax obligations for the year 2024.

Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure that taxpayers with significant income and certain types of deductions pay at least a minimum amount of tax as highlighted in Tax Foundation. In 2024, the AMT framework undergoes key adjustments due to inflation.

For single filers, the AMT exemption amount is set at $85,700 and begins to phase out at income levels of $609,350. Married couples filing jointly see their AMT exemption amount start at $114,600 with phase-outs commencing at $1,047,200.

The tax rates for AMT are two-tiered:

- The first tier is 26% for AMT taxable income up to $206,100 (applicable to both single and married filers).

- Amounts over the $206,100 threshold are taxed at 28%.

It should be noted that these figures can be influenced by future legislation that could change aspects of how the AMT is calculated or applied. Taxpayers are encouraged to consult a tax professional or the AMT guidelines as published by the Internal Revenue Service for the most precise information for their specific situations.

What is the Tax Filing Procedure?

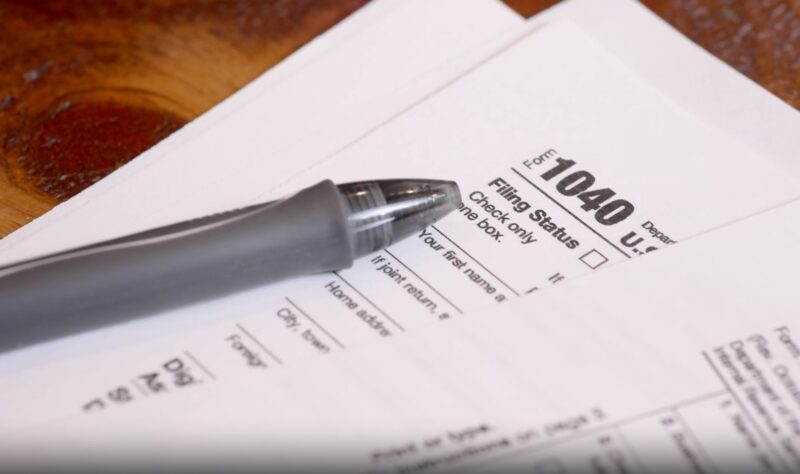

When preparing for the tax season, taxpayers should be keenly aware of their filing status, the required deadlines for submitting their tax returns, and the process to request an extension, should they need additional time.

Filing Status

- Single: Individuals not married by the end of the tax year.

- Married Filing Jointly: Couples who are married and combine their income in a joint tax return.

- Married Filing Separately: Married couples who choose to file their incomes, exemptions, and deductions on separate tax returns.

- Head of Household: Unmarried individuals who pay more than half the cost of keeping up a home for themselves and a qualifying individual.

- Qualifying Widow(er): Those who have lost a spouse recently and have a dependent child.

Filing Deadlines

The deadline to file federal income tax returns is typically April 15 of each year. However, if the date falls on a weekend or a public holiday, the deadline may shift to the next business day.

Extension Requests

Taxpayers who require more time to gather necessary documents or fill out their returns have the option to file for an extension, which grants them an additional six months to submit their tax forms. To avoid penalties, one must file Form 4868 by the original due date of April 15. It’s crucial to note that the extension applies to filing but not to payment obligations, so estimated taxes should still be paid by the original deadline to avoid potential interest and penalties.

Estimated Tax Payments and Withholding

In 2024, estimated tax payments are periodic prepayments typically required of self-employed individuals, investors, and others who do not have taxes withheld from their income. They are calculated based on the taxpayer’s expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

Taxpayers should make these payments if they expect to owe at least $1,000 in tax after subtracting their withholding and credits. If one fails to make these payments or underpays, they may incur penalties according to the IRS.

On the other hand, tax withholding refers to the amount of an employee’s pay withheld by the employer and sent directly to the government as partial payment of income tax. The goal is to match the withholding as closely as possible to the actual tax liability for the year. For accurate withholding, employees need to provide their employers with an up-to-date Form W-4.

The IRS’s Tax Withholding Estimator is a useful tool that can help taxpayers check if the right amount of tax is being withheld from their paychecks. Adjustments can be made at any time during the year to the Form W-4 if life changes occur such as marriage, childbirth, or a secondary income source.

While employees have taxes withheld from each paycheck, self-employed individuals and others must proactively manage their tax payments throughout the year to avoid underpayment penalties. They must utilize available resources to estimate their tax and make timely payments.

FAQ

How do the 2024 tax brackets compare to those in 2023?

The Internal Revenue Service adjusts tax brackets annually for inflation. The 2024 tax brackets are marginally higher than the 2023 tax brackets, ensuring that taxpayers don’t pay more due to inflation-induced wage increases.

What are the federal tax rates for the year 2024?

In 2024, the federal income tax retains seven rate tiers: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The 37% rate applies to single filers with income over $609,350 and married couples filing jointly with income over $731,200.

How can I calculate my federal income tax for 2024?

Calculating federal income tax involves considering your income, deductions, tax bracket, and applicable credits.

What is the standard deduction for individuals and couples in 2024?

The standard deduction for the 2024 tax year has been inflation-adjusted. While current figures from the IRS aren’t listed in these responses, up-to-date information can be found by consulting the IRS’s tax year updates.

Are there any new tax rules or changes in 2024 that I should be aware of?

Each tax year can introduce new rules and changes that might affect taxpayers.

What are the federal income tax implications for those over 65 in 2024?

Taxpayers over 65 often qualify for higher standard deductions and might have different tax considerations.

Final Words

By staying informed on these aspects, taxpayers can better manage their finances and comply with U.S. tax laws, potentially minimizing their tax liability while ensuring they meet their legal responsibilities.